Worked Example

- Apr 22, 2018

- 4 min read

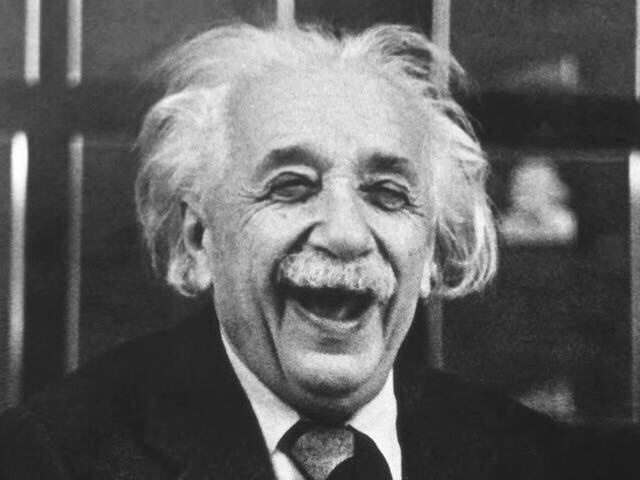

This artifact is based on the worked example principle as it applies to multimedia learning. Learners prefer worked examples by doing and learning in order to solve complex problems. Learning by doing was promoted by John Dewey in the early 1900's where he advocated for vocational training. This work example, a video, is created to learn about compound Interest and be able to apply the formula which as Albert Einstein stated, "Compound interest is the eighth wonder of the world. He who understands it, earns it...[and] he who doesn't ....pays it."

By using worked examples, I am applying Clark and Mayer's segmenting and pretraining principles to avoid cognitive overload. By segmenting, breaking a lesson into manageable segments and by pretraining, providing the concepts beforehand, the learner should be able to avoid extraneous cognitive processing and not feel overwhelmed.

In creating this video, I tried to follow a three-sequence step for forming the learning worked examples. First, I established a objective, compound interest, and the importance of learning it. Second, I provided explanations of some of the concepts and several worked examples to demonstrate how the principle and formula is administered to the problem, and third, I gave practice examples so the learners gained some understanding of how to apply the formula to solve other interest problems in the real world.

I created this video utilizing a new software program Explain Everything on my IPad.

Artifact's:

3.1 Creating - Candidates create instructional design products based on learning principles and research-based best practices. This video is based on applying Clark and Mayer's segmenting and pretraining principles through worked examples. By creating a video the learner can manage the segments and control their learning so they don’t have a cognitive overload.

3.2 Using - Candidates make professionally sound decisions in selecting appropriate processes and resources to provide optimal conditions for learning based on principles, theories, and effective practices. I utilized the program Explain Everything on my IPad. Although the software program was new to me and I had never created a video before on my IPad, I was impressed and the software program easily exported the file out.

Script for Working Example:

Hi, I am Suzi. Today we are talking about compound interest.

As Physicist and theorist Albert Einstein stated “Compound interest is the eighth wonder of the world. He who understands it, earns it…[and] he who doesn’t…pays it.”

Albert Einstein was so impressed with this concept that he called compounding “the most powerful force in the universe”

If you can you should always pick compound interest over simple interest.

I will be explaining why.

It is like a snowball. The snowball starts rolling down a hill and it starts out small but the faster and farther it rolls the bigger it gets. That’s because when it comes to building wealth, time is much more powerful than the amount you invest and even the return you earn.

As interest is added –with the mighty power of compounding you earn interest on the original balance plus the previously earned interest. So, through compounding, you make money of the interest which the more frequently interest is compounded, the more the balance increases.

The is a price to procrastination by waiting to invest. You are paying an opportunity cost. The opportunity cost is an economic term meaning what you forego or give up. In this case it would be the compound interest.

First let’s start with the Simple Interest Rate Formula I=PxRxT

Where:

I = Interest

P = Principal (the original invested amount)

R= interest rate (decimal number)

T = time (number of years)

Example: $2.75 = $500 x .025 x 1

When interest is compounded, the amount paid in a year is actually more than when the simple interest formula is used to calculate the interest

The financial institutions show the return as the annual percentage yield (APY), the actual return on an investment when compound interest is taken into account

Compound Interest Formula:

A = final amount including interest after t years

P = principal (original invested amount)

r = annual interest rate (decimal number)

n = number of times interest is compounded each year

t = number of years the amount is invested

Example: final amount = $500 (principal) (1 + .025(rate)/365(how often compounded) 365 * 1

A = P(1+r/n) nt

Now

Step 1 write the formula down if you haven’t already

Step 2 put in “P” the principal amount or original investment

Step 3 put in “r” the annual interest rate in decimal format

Step 4 put in “n’ the number of times interest is compounded per year

Step 5 put in “n” again and put in ”t” as the times in years for the exponential

Step 6 solve divide r by n add one and multiply the n and t (as an exponential)

Step 7 multiply the answer in the () by the exponential then by P to get A

Again in front of you is

A = Principle parenthesis (1+ r (interest rate) /n by the number of times the interest is compounded) exponential parenthesis n *t

A=P(1+r/n)nt

Now practice on the examples

Assumption – Investment is calculated as interest is compounded daily

Diana invests $500 earning 7% for 5 years

Diana invests $500 earning 10% for 10 years

Diana invests $1000 earning 4% for 20 years

Extra: What if Diana has a thousand but she needs to save four thousand in four years? What rate of return (interest rate) does she need? Hint A=P +I

Since compounding interest is so important remember to always shop around for the best interest rates and how often the money is compounded

Thank you for watching about compounding interest

Comments